Now, Only Death is Certain

As a CPA, I'm actually interested in tax policy in a more in depth fashion than tea partiers who oppose all taxes on principle. Opportunities to write about this topic, though, have been few and far between. Thanks to our newly minted all-Republican legislature, I now have my shot.

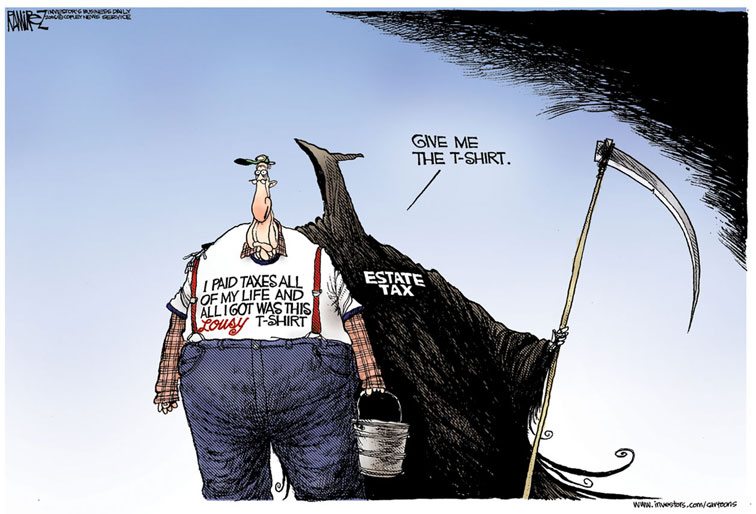

On January 1st of this new year, the estate tax has been completely repealed. Most of you probably read "estate tax" and wonder what the hell I'm talking about. Instead, you may know it by it's more colloquial title, the "death tax," or as conservatives refer to it:

Awesome marketing slogan that conjures the image of Uncle Sam going through the wallets of corpses aside, opponents of the estate tax have insisted that taxing inheritance punishes the offspring who helped build that wealth (estates transferred to spouses are exempt from the tax). Personally, I have always failed to see how this has been near the top of the Republican platform for decades. The "Death Tax" is one of the most extravagant tax loopholes on the books.

If you don't believe me on this, I have advice for completely avoiding all "death" taxes: Take Jesus' advice and give away all of your possessions while you are still alive. Do that, and there will be nothing left to tax once you get six feet under. However, while you're alive you will pay a crap ton to the government.

You see, when you die, only the net value of your belongings in excess of $1MM (federally) is subject to estate tax. That comes to less than 1% of all estates. Prior to Oklahoma abolishing it, estates had to be worth more than $3MM before the state took a cut.

Those who applaud the repeal of the tax believe it is unfair to tax inheritance, at all. However, the logic hits a snag when one notices that income is taxable. Why is it that if a person works a 40 hour week and is paid by their employer that the exchange of money is subject to tax, but the spoiled heir of an oil mogul should get their parent's life savings for free? At minimum, the transfer of wealth should be considered a gift, right?

This brings me back to my point about giving it away while alive. Gifts are limited to $13K per person per year before those transfers trigger tax liability. So, to get the same tax advantage of waiting to pass an estate on at death, the living person would have to shell out to their child the yearly limit for 77 years for Federal, or 231 years for Oklahomans who died prior to January 1st of this year. That does not take into account the capital gains taxes that are also waived for "death tax" computations.

Sidenote: Oh, by the way, those limits are for each beneficiary, not the total estate...so if Luke Corbett has 250 kids, each of them can have an equal share of the (publically reported) payout he received for shipping Kerr-McGee to Houston without having to pay a dime of taxes to any government.

But, keep believing that the "Death Tax" is completely unfair.

Read More:

Stay in touch

Sign up for our free newsletter